federal tax abatement meaning

A reduction in the amount of tax that a business would normally have to pay in a particular. IRS Definition of IRS Penalty Abatement.

A tax abatement is an agreement between a local government and a property owner to exempt part of the taxes owed in return for improvements to the property.

. On line 608 enter the amount of federal tax abatement. In effect a tax abatement lowers the tax liability. A tax abatement is a reduction in the amount of taxes a business or individual must pay to the federal state or municipal levels of government.

Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file. When you get a tax abatement the government is essentially giving you a tax break on certain types of real estate property business. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would.

Taxpayers use Form 843 to claim a refund or abatement of certain overpaid or over-assessed taxes interest penalties and additions to tax. What happens during an abatement period. They can gain the full exemption if they file before February 15 of that year.

More from HR Block. For instance local governments may offer abatements to cover the cost of building new infrastructure to. In some instances an abatement can also result in a reduction of penalties imposed.

The policy owner of this IRM section is the Director Collection Policy. In cases where taxpayers request abatement the. The federal tax abatement reduces Part I tax payable.

Abatements are governed. A sales tax holiday is another instance of tax abatement. Tax Abatement in Cincinnati.

Homeowners can receive a 7000 exemption on their propertys assessed value for their main home if they reside in it on January 1. The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory. The federal tax abatement reduces Part I tax payable.

The city of Cincinnati taxes homeowners only for the pre-improvement value. If the IRS has assessed a penalty against you because of failure to file failure to. The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits.

The IRS grants abatement or tax relief only to taxpayers who have proven reasonable causes behind a penalty despite tax trouble. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. Penalty abatement removal is available for certain penalties under certain circumstances.

The primary audience for this IRM is Field Collection employees and their managers. Tax Abatement in California. Tax Penalty Abatement.

An abatement is a reduction or an exemption of a tax for an individual or a company. Tax abatements typically take the form of a decrease in the amount of tax owing or a rebate being issued. Income earned outside Canada is not eligible for the federal tax abatement.

What is a tax abatement in Texas. Examples of an abatement include a tax decrease a reduction in penalties or a rebate. The IRS abates a small portion of tax penalties every year.

Tax Penalty Abatement Penalty abatement is a federal relief program designed to help those whove made a mistake and have incurred penalties. CCPCs that meet the definition of qualifying corporation can also earn ITCs at the enhanced rate of 35 on qualified SRED expenditures up to their. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount.

In other words when your taxes are abated it means that your taxes are lowered. A reduction of taxes for a certain period or in exchange for conducting a certain task. For example in 2019 the agency abated just 9 of total individual penalties and 12 of failure-to-file and failure-to-pay penalties.

During the abatement period you are not required to pay. In broad terms an abatement is any reduction of an individual or corporations tax liability. The meaning of TAX ABATEMENT is an amount by which a tax is reduced.

If an individual or. Tax abatements can be granted by any local government that collects ad valorem or value-based property tax however abatements can be granted only for property within a reinvestment zone. Abatement is a reduction in the level of taxation faced by an individual or company.

Income earned outside Canada is not eligible for the federal tax abatement. This IRM provides guidance and instruction to SBSE employees in Field Collection for requesting abatements adjustments and processing reconsiderations. While tax abatements are most commonly associated with.

Income earned outside Canada is not eligible for the federal tax abatement. The main reason the IRS doesnt abate penalties is that most taxpayers dont request penalty abatement. The federal tax abatement reduces Part I tax payable.

For example the Portland Housing Bureau says its tax abatement program could save property owners about 175 a monthor about 2100 a yearfor a. Tax abatement is a kind of relief the IRS grants to taxpayers who exert effort to comply with the law but are unable to fulfill their tax obligations because of uncontrollable events. A reinvestment zone or a tax increment reinvestment zone is an area in which a local government has designated to raise funds through future tax.

Tax Abatement Meaning. This makes sense because the legal definition of abatement is a reduction suspension or cessation of a charge.

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

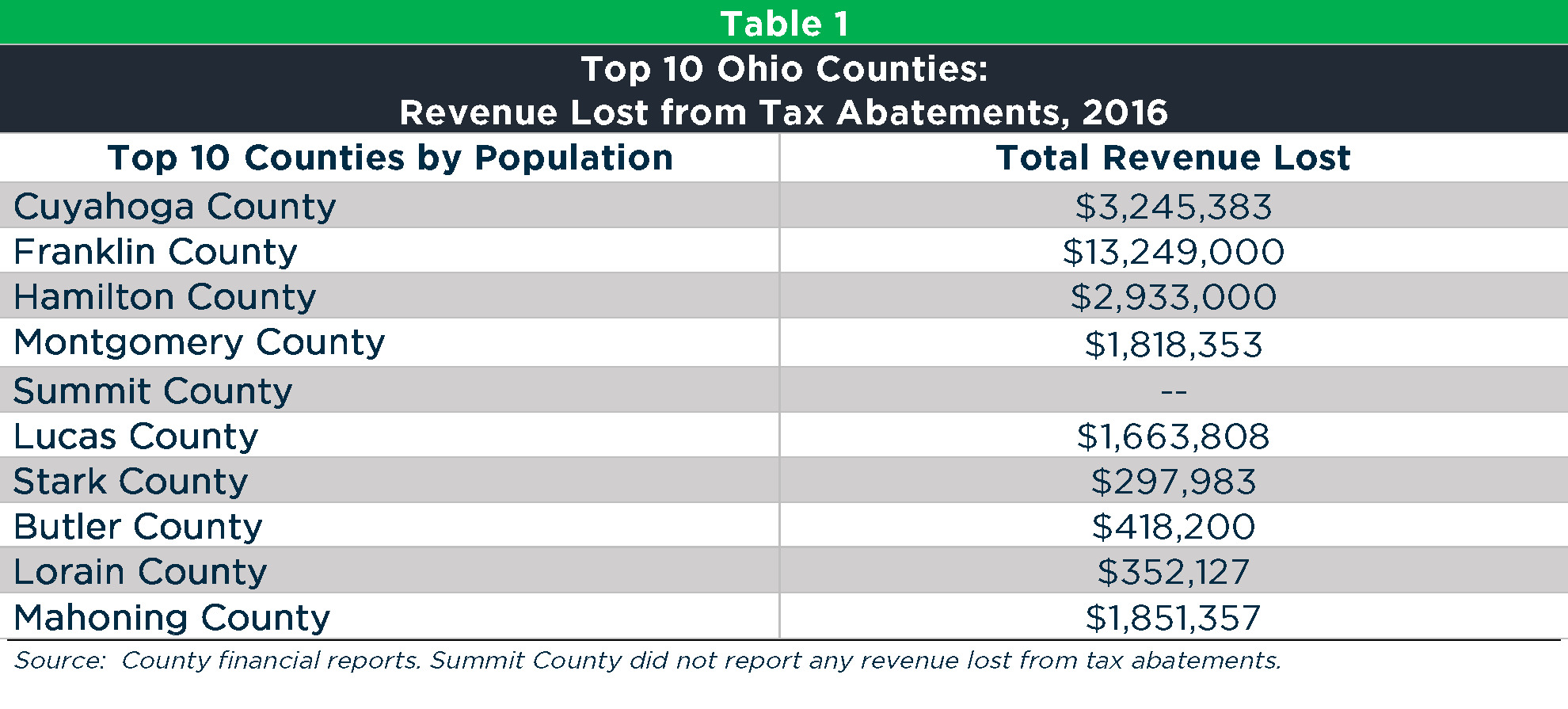

Local Tax Abatement In Ohio A Flash Of Transparency

What Is Tax Abatement A Guide For Business Operators

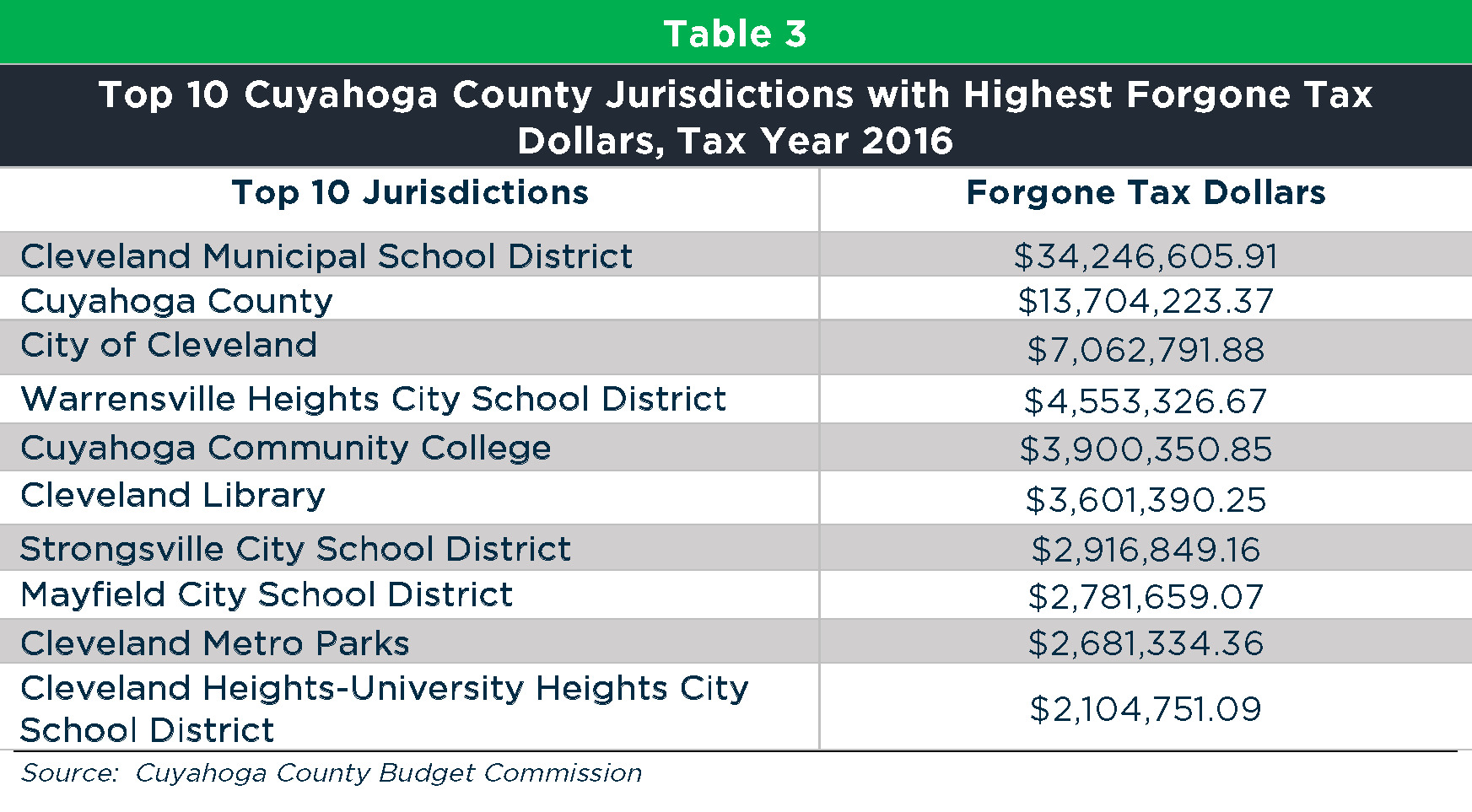

Local Tax Abatement In Ohio A Flash Of Transparency

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

Module 8 Taxable Income And Tax Payable Pd Net

What Is A First Time Irs Penalty Abatement

Irs Letter 854c Penalty Waiver Or Abatement Disallowed H R Block

How Much Is The Coop Condo Tax Abatement In Nyc

Tax Penalty Abatement Help In California My Tax Settlement

What Is A Tax Abatement Quickbooks Canada

Doing Business In The United States Federal Tax Issues Pwc